After weeks of waiting, the flow of economic information is just now beginning to emerge from a shutdown induced hibernation. The long layoff left many economic reports from jobs data to inflation statistics either delayed or incomplete, making it harder to get a clear read on where the economy stands. While the oldest reports have finally been released, others are still weeks away, keeping uncertainty elevated as we move toward 2026. Hopefully, with reporting back on track, a clearer picture will emerge soon.

Headlines

November Jobs Report - The long-delayed September jobs report showed the U.S. added 119,000 jobs, beating expectations, after August was revised down to a loss of 4,000 jobs. The unemployment rate rose to 4.4%, the highest since 2021, while wage growth slowed to just 0.2% for the month. This release ends a data blackout caused by the 44-day government shutdown, which prevented the collection and publication of October figures. In fact, the BLS confirmed that no standalone October jobs report will be released at all. Alternatively, any October data will be combined with the November report and released on December 16, 2025, narrowly missing our publication deadline.

Weekly Jobless Claims - Weekly jobless claims surged by 44,000 to 236,000, the largest jump in more than four years, though economists attribute the rise mainly to seasonal volatility. The four-week average inched up to 216,750, suggesting underlying stability despite the noise. Continuing claims fell by 99,000 to 1.838 million, partly due to workers exhausting benefits. Locally, Utah also saw an increase: new claims rose by 988, climbing from 1,513 to 2,501 week over week. This mirrors the broader national pattern of temporary fluctuations rather than a clear shift in labor conditions.

Consumer Price Index - The November CPI report is scheduled for release on December 18th, but because of the timing, we won’t be able to include it in this month’s publication. We will share the full update next month once the official data is available. The October CPI report was also canceled by the Bureau of Labor Statistics due to the government shutdown, which prevented proper data collection. Any partial October data will be combined into the November release, meaning there is no standalone CPI figure for October. The most recent official data remains the September CPI report, which showed a 3.0% annual inflation rate and a 0.3% month-over-month increase. September’s inflation was driven by higher shelter costs and energy prices, while core inflation continued to cool at a steady pace, signaling a gradual easing of price pressures heading into the fourth quarter.

Fed Meeting - The Federal Reserve delivered its third rate cut of the year, reducing the federal funds rate by 0.25% to 3.5%–3.75%, but signaled that further cuts will be slow and limited. The decision revealed unusual division inside the Fed, with a 10–3 vote: one member wanted a larger cut, while two wanted no cut at all. Updated projections show policymakers expect only one additional cut in 2026 and another in 2027, reflecting a cautious outlook. Alongside the rate cut, the Fed also announced it will resume buying Treasury securities, starting with $40 billion in T-bills, to support short-term funding markets. Chair Jerome Powell said the Fed is now positioned to “wait and see,” reinforcing expectations of a slower easing path ahead.

What Property Owners Should Expect in the 2026 Rental Market

As we approach 2026, multiple major housing-market forecasts point toward a period of stabilization, modest growth, and shifting renter dynamics. For property owners, the year ahead will bring opportunities but also challenges that suggest a need to adapt strategies, upgrade operations, and rethink how rentals are marketed and managed.

Home-Sale Market Easing — Which Affects Supply and Demand for Rentals

According to Zillow, home values nationwide are forecast to rise only modestly by 1.2% in 2026. This suggests that rapid price increases seen in previous years are finally calming. Zillow expects existing U.S. home sales to tick up to 4.26 million units, a 4.3% increase over 2025 as affordability slightly improves.

For landlords and rental investors, that likely means less pressure from prospective buyers entering the for-sale market at least in many metros. With fewer would-be homeowners buying, demand for rentals may remain steady or even increase in certain markets. Moreover, slower home-price growth also means fewer homeowners will find themselves “underwater,” reducing distressed sales and foreclosures.

That said, construction of new single-family homes is projected to remain weak. 2026 could be the “slowest year for single-family starts since 2019,” according to Zillow, so we are not expecting a large uptick in supply. If new inventory isn’t being built, this would further limit supply growth over the long term and support the case for rentals as a stable asset class.

Rent Growth Slows But Rents for Some Segments Will Rise

A key takeaway from the research is that rent increases will be modest — but not uniform. Zillow forecasts that multifamily (apartment) rents will rise only ~0.3% in 2026. Single-family rents — homes not in large apartment buildings — may see higher increases, as buyers continue delaying purchases.

However, some market-level forecasts anticipate a stronger rebound. According to data from RealPage Market Analytics (summarized in a recent article), effective asking rents across the U.S. are expected to climb roughly 2.3% in 2026. This is a notable shift after a 0.7% decline in the previous period.

What this means for owners: rent growth may be sub-par in some segments (especially multifamily), but owners with single-family rentals or properties in high-demand metro areas could still see solid income growth. In this mixed environment, location, property type, and marketing strategy will matter more than ever.

What Owners Should Do Going Into 2026

Reassess your portfolio — single-family homes and properties in high-demand areas may outperform larger multifamily buildings in weaker markets.

Focus on retention and tenant experience — with more competition, keeping good tenants may be more cost-effective than continuously chasing new ones.

Plan for expenses and maintenance proactively — preventative maintenance will help preserve property value and avoid costly repairs.

Be selective about acquisitions — evaluate local supply/demand dynamics, vacancy rates, and tenant demographics before buying.

Overall, 2026 looks like a year of measured opportunity for property owners rather than a boom or crash. Owners who treat rental properties as long-term, service-oriented investments and who adapt to evolving tenant expectations are likely to fare best.

Utah Real Estate Market

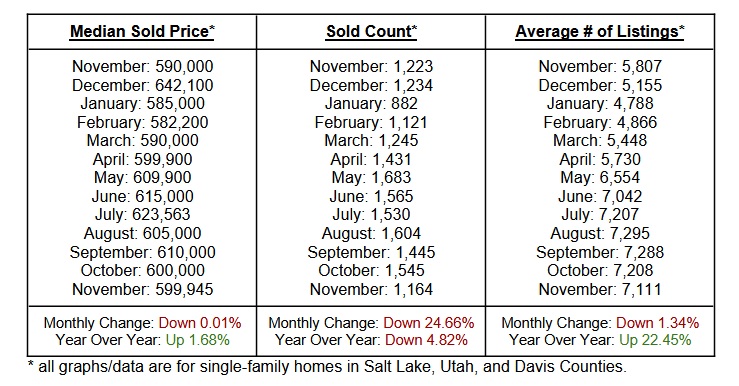

The Utah real estate market softened in November as seasonal patterns and shifting buyer activity continued to influence market behavior. The median sold price held remarkably stable at $599,945, slipping just 0.01% from October while staying 1.68% higher year over year, signaling that home values remain resilient despite minor month-to-month fluctuations. Sales volume cooled more noticeably, falling 24.66% from last month, reflecting typical late-fall slowdowns and more selective buyer behavior. Inventory also edged down slightly to a 1.34% decline from October but remains 22.45% higher year over year. Overall, November presents a picture of a stabilizing market: steady pricing, slower sales activity, and inventory levels that continue trending upward on an annual basis, creating more balanced conditions as the year winds down.

Rent Report

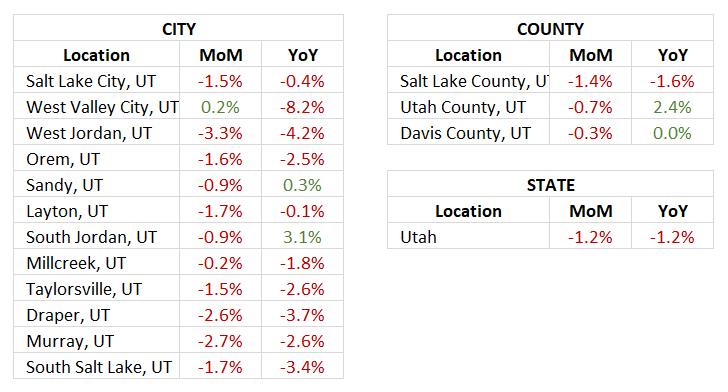

Utah’s rental market softened further in November, with most cities and counties posting modest month-over-month declines. Statewide rents dipped 1.2%, matching the 1.2% annual decline, signaling continued cooling as the market adjusts to shifting demand. At the county level, Salt Lake County saw a 1.4% MoM drop, while Utah County experienced a smaller 0.7% decline but remained up 2.4% year over year, making it the strongest-performing county annually. Most cities recorded slight monthly decreases, with West Jordan, Draper, and Murray seeing the largest pullbacks. However, a few pockets showed resilience: West Valley City posted a minor 0.2% monthly increase, and South Jordan led year-over-year gains at 3.1%, signaling localized strength despite broader statewide softness. Overall, November reflects a market that continues to cool gradually, with mixed performance across cities but stable long-term demand in select areas.

*Rental data provided by apartment list.

Industry Updates

HUD Announces Key Fair Housing Updates - HUD released new guidance updating how fair-housing laws will be enforced, particularly in three areas: criminal-history screening, assistance-animal requests, and disparate-impact claims. The agency clarified that housing providers must ensure criminal screening policies are individualized and not overly broad, that assistance-animal requests must be evaluated using consistent, reasonable-accommodation standards, and that disparate-impact cases will now focus more on proven discriminatory outcomes rather than technical violations. Overall, the update signals a shift toward clearer rules and more targeted enforcement, meaning housing providers may need to revisit their policies to ensure they align with HUD’s refined standards.

Vacancies Will Last Longer Than Expected - According to a new analysis by CoStar, apartment oversupply in certain markets is proving harder to absorb than previously thought meaning vacancies are likely to remain elevated for longer than forecast. That prolonged vacancy outlook stems from slower absorption rates and ongoing demand-supply imbalances in some areas. Because of this, landlords in affected markets may face extended periods of lower occupancy and potential pressure on rents. For property owners, the takeaway is a need for greater caution and more adaptive strategies: you may want to adjust expectations for rental income growth, emphasize tenant retention, consider incentives or upgrades to attract renters, or explore diversification beyond oversupplied apartment segments.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai